At a time when the appeal of and demands for a new “democratic” socialism seem to have caught the imagination of many among the young and are reflected in the promises of a good number of political candidates running for high office, there is one already-existing socialist institution in America with few opponents: the Federal Reserve System.

The fact is, central banking is a form of central planning. The Federal Reserve has a legal monopoly over the monetary system of the United States. It plans the quantity of money in circulation and its availability for lending purposes; and it sets a target for the annual rate of price inflation (currently around 2 percent), while also intentionally influencing interest rates, affecting investment spending, and supporting full employment. Almost all discussions and debates concerning the Federal Reserve revolve around how it should undertake its monetary central planning: which policy tools should be used, what target goals should be aimed for, and who should be in charge of directing America’s central bank.

Federal Reserve Independence in the Trump Era

A complementary issue that has received renewed attention concerns the question of how much “independence” the Federal Reserve and other central banks should have to determine and implement monetary and interest rate policy. This has recently come to the fore due to comments made by President Donald Trump concerning Federal Reserve interest rate policy and the individuals he has recently proposed for positions on the Federal Reserve Board of Governors.

Several times over the last year, President Trump has expressed irritation and frustration with increases in market rates of interest under the Federal Reserve Board leadership of Jerome Powell, who Trump nominated for Fed chairman and who has held that position since February 2018. Trump has publicly pouted and whined that while Barack Obama was president he had a central bank that gave him rock-bottom low interest rates. Fed Chairman Powell, on the other hand, has raised interest rates several times over the last year, preventing America from being as “great” as Trump thinks it can be because of the higher costs of borrowing for both the private sector and the federal government.

Being informed that he really cannot just fire Chairman Powell because he doesn’t like Federal Reserve policies, Trump wants to get around the Powell problem by nominating for open positions on the Fed Board those he thinks will more likely direct Federal Reserve policies in the way he wants. Thus, he has put up as names for Senate approval those of Stephen Moore, a policy analyst at the Heritage Foundation and a former Trump campaign advisor; and Herman Cain, the former CEO of Godfather’s Pizza, a previous chairman of the Kansas City branch of the Federal Reserve, and a past Republican presidential hopeful himself.

Trump Critics on the Left, on the Right, and at the Economist

Trump has been attacked from both the left and the right for seeming to want to pack the Federal Reserve Board of Governors with “political” types reflecting Trump’s desire for looser monetary policy and lower interest rates. Some on the political left oppose his nominees simply because, well, they are Trump’s choices, along with the additional criticisms that neither are Ph.D. economists nor known and respected experts on monetary policy.

Others more to the political right don’t want them on the Board because they would prefer a more “hawkish” Fed policy. Desmond Lachman, a resident scholar at the conservative American Enterprise Institute, thinks the Federal Reserve should raise interest rates so the central bank will have the room for future successful monetary-stimulus policies when the next economy-wide downturn comes along. In other words, he just wants monetary central planning in a different direction than President Trump.

The Economist magazine had as its cover topic for the April 13, 2019, issue the threat to central bank “independence” from Trump and others like him in charge of governments around the world. What is needed and has to be preserved, the Economist argues, are professional monetary-planning “technocrats” who rise above and are free from interference by politicians, so those at the central banking helm can focus on long-run price-level stability and non-ideological banking and interest rate policies.

The magazine admits that central bankers have not always gotten it right — even the most well-intentioned central planner is only human, let’s not forget — but in their wise hands the world has been saved from destabilizing price inflations and short-run policy manipulations that might have been harmful to full employment and steady growth.

The “Austrian” Critique of Central Planning vs. Markets

Rarely heard or suggested in all these commentaries on the Federal Reserve is whether the United States needs or should have a central bank. I would like to suggest that the answer is no, and for many of the same reasons that can be made against socialist central planning in general.

It will be 100 years in 2020 since the Austrian economist Ludwig von Mises first published his famous critique of socialist central planning in his article “Economic Calculation in the Socialist Commonwealth” (1920) and then extended the challenge to all facets of collectivism in his 1922 book, Socialism: An Economic and Sociological Analysis. The gist of his argument was that a centrally planned economy did away with the essential institutions necessary for rational economic calculation: private property in the means of production, market competition, and a functioning price system.

In a complex and ever-changing social system of division of labor all the multitudes of participants are interdependent for all the things needed for everyday life. It is necessary to have some means of knowing what it is that people want to buy in their role as consumers and the value they place on those things; and it is also essential to know what resources are available out of which desired consumer goods might be produced, and what their values might be in the alternative uses for which they could be applied.

In other words, do consumers desire hats, or shoes, or bananas, or breakfast cereal, or classical music, or serious books on economics, or anything else, and what are the relative values they may place on possibly purchasing them? At the same time, what are the available types and quantities of labor, land, resources and raw materials, and capital goods (machinery, tools, equipment) that may be used in various combinations to produce those consumer items, and what might be their appraised values in being employed in different and competing lines of production?

Market Prices and Economic Calculation

The market solves that problem, Mises explained, through the emergence of a competitive price system for both finished goods and the factors of production. With exchangeable private property there are opportunities to buy and sell; with the ability to buy and sell, people have motives and incentives to make bids and offers to each other; out of those bids and offers may arise agreed-upon terms of trade; and those agreed-upon terms of trade create the complex structure of relative prices for both those finished goods and the factors of production.

In a complex market system there also historically emerged a medium of exchange to overcome the hurdles of direct barter transactions to better facilitate the buying and selling of virtually everything. As the most widely used and generally accepted medium of exchange, the commodity that becomes the money-good comes to be on one side of every exchange.

People trade their goods for money, and then trade away that money for other goods they desire to buy. Almost every good and service on the market, therefore, comes to have a money price that then enables an ease of economic calculation through which all the physically heterogeneous goods offered on the market may be expressed in a single valuational common denominator — the money prices for everything.

Thus, all traders on the market can readily do their “comparison shopping.” What would this bundle of consumer items cost me to buy and what are the relative costs if I substitute one good for another to buy instead? If I buy one hat for $10, then I have to forgo the equivalent of two pairs of gloves that cost $5 a piece.

The same applies on the supply side of market production decisions. The entrepreneur can try to make an informed judgment concerning what a consumer good sells for in the present and might possibly sell for in the future if he were to bring some quantity of it to market. Likewise, he can determine what it would cost to rent, hire, or purchase alternative combinations of inputs (labor, land, capital) to manufacture some such consumer item, on the basis of which he can decide whether he thinks that doing so would be a profit-making or a loss-making endeavor; and if seeming to be profitable, which combination of those inputs would minimize his costs of production to potentially maximize the anticipated and hoped-for profits?

Central Planning Leads to Planned Chaos

A system of socialist central planning does away with all of this. With government nationalization of the means of production there is nothing to (legally) buy and sell on the production side of the economy. With nothing to buy and sell, there are, obviously, no bids or offers for the factors of production. With no bids and offers for labor, land, resources, and capital, there are no market-based prices for appraising profitable from unprofitable lines of production, and deciding which alternative ways of making finished goods would minimize the costs of production.

It is not surprising that a bit more than a quarter of a century after Mises first offered his criticisms of socialist central planning he titled a short monograph on the same theme Planned Chaos (1947). Without market-based and competitively generated prices to assist the ongoing process of rational economic calculation in a changing world, the central planners would be “flying blind” in trying to decide what to produce and how to produce it to get the most out of the scarce factors of production in value terms in supplying the goods and services consumers actually might want to buy and what they would have been willing to pay for them. (See my article “Why Socialism Is ‘Impossible.’”)

Most economists around today would find the gist of this argument fairly obvious if asked to agree with it or not, even if many mainstream economists would no doubt insist that there were problems of monopoly and undersupplied public goods, and assert the need for various redistributive welfare programs outside of the arena of market exchange due to income inequalities. But the notion that market-based, competitive prices enable effective and cost-efficient economic calculation for much that goes on in a complex society would be accepted, in this general formulation, without too much disagreement.

Central Banking Denies Freedom of Choice in Money

On this basis, I would argue that monetary central planning in the form of central banking creates many of the same problems for economic calculation and effective and efficient use of resources as traditional socialist economic planning. First of all, what commodity (or commodities) should be used as a medium (or media) of exchange? Under our current monetary system, anyone who attempts to offer and market alternative monies for use in domestic transactions is subject to legal penalty including arrest and imprisonment.

For instance, back in the late 1990s, Bernard von NotHaus decided to mint and market an alternative “private voluntary currency” for business and related transactions. In 2009, Mr. NotHous was arrested for circulating millions of his gold coins called Liberty Dollars in over 80 cities on counterfeiting charges and for undertaking a “conspiracy” against the U.S. government’s monetary monopoly. He was found guilty in 2011, and in 2014 he was given six months’ house arrest and three years’ probation. In 2018, Mr. NotHous was back, this time saying that he was starting up a cryptocurrency that was to be 100 percent backed by silver. How the government responds this time to his attempt to undermine America’s socialist monetary system remains to be seen.

But the fact is, how can any government and even the wisest and most Ph.D.’ed of their Federal Reserve experts know what people in the marketplace would find attractive, advantageous, and profitable to use as a medium of exchange in market transactions, or whether there might not be a demand for different types of money for different forms of market activities?

The answer is that there is no way of fully knowing this other than allowing private enterprisers and entrepreneurs in the financial and other everyday markets to competitively discover and offer what we the buying and selling public might want for this purpose. It is now more than 40 years since Austrian economist F.A. Hayek published his “Choice in Currency,” (1976) in which he called for the simple monetary reform of ending legal tender laws and allowing people to choose and use in domestic and foreign transactions any medium of exchange they desire. He considered this a necessary freedom to break the history of abuse under government-monopoly money and to allow people to use whatever money they want.

Only Markets Can Discover the Optimal Amount of Money

Second, how can the monetary central planners know how much money should be in circulation and in the banking system? This is no more possible than the old Soviet central planners knowing how much toilet paper to produce or the quantities and varieties of any other everyday household necessity. What the Soviet planners produced invariably turned out to be in the wrong amounts and of the wrong types. A visit to a “people’s” lingerie store (and I use this term very loosely) in Moscow before the collapse of the Soviet Union found one-size-fits-all in women’s underpants. Any needed adjustment of the waistband, well, comrade, that is what safety pins are for. No unnecessary quantities or wasteful duplication under bright and beautiful socialist planning. The central planners were, no doubt, Soviet socialism’s best and brightest — and with Ph.D.’s!

Under a commodity money such as gold in a fully free-enterprise system, the amount of money in the market is a reflection of supply and demand. People have uses for gold for either commercial or monetary purposes. Gold has its price in the marketplace. Based on this those on the supply side could estimate the profitability of prospecting, mining, minting, and marketing greater quantities of produced gold for sale for monetary and other commercial uses.

An increased demand for gold as money sees a shift of the commodity from commercial uses to monetary ones, and with the resulting rise in the value of gold in general, a greater profitability from gold prospecting, mining, and minting. As the supply increases, the rise in the market value of gold is tempered, with the increasing supply tending to satisfy the greater demand. Yes, there have been noticeable gold-based fluctuations due to newly discovered gold sources in various parts of the world. But in general these incidents have been few and far between, with gold annually being extracted from known pockets based on current and trend demand.

The crucial element in this is that the “optimal” quantity of money is the interactive outcome of the market participants themselves. The gold market provides the price system that reflects the demand for gold in its various uses, of which money is one. And the related markets for the needed means of production to mine, mint, and supply gold provide the cost prices that facilitate the rational economic calculations for an ever-adapting and ever-adjusting “optimal” market-guided quantity of money. (See my article “Government, Gold, and Separating Money from the State.”)

The Central Bankers Determine How Much Money

Today we are dependent on the decisions of a handful of central-planning executives on the Board of Governors of the Federal Reserve. What is their guide? The personal judgments of what they think the economy needs, based upon the prevailing macroeconomic theories used in the central bank about how the economy works and therefore how much money should be pumped into the banking system.

Our monetary fate is dependent upon whether the central bank experts, this year, are old-style Keynesians, new Keynesians, monetarists, new classical economists, Taylor-rule followers, supply-siders, new modern monetary theorists, or any number of other possibilities. In the old Soviet Union, it all depended upon whether Stalinists or Trotskyites were to be in charge; for the central planning of scientific research, genetics was or was not considered compatible with Marxism-Leninism as interpreted by the leadership of “the Party.”

Just as it is said that central banking needs to be independent so the “objective” and scientific monetary “experts” can guide the economy based on the latest and “correct” macroeconomic models, it was insisted under Soviet and all other socialisms-in-practice that it was all objective and scientific, being based on Marxian dialectical materialism, given what that meant in any particular situation. It’s all a politics and ideology of planning. A few say they know what is right for the many, and will use government to give it to them.

The False Target of 2 Percent Price Inflation

Also important to keep in mind is that there is no optimal rate of price inflation. To begin with, any benchmark meant to determine whether prices in general are rising or falling is based upon some statistical averaging of selected and weighted individual prices tracked through time to determine whether or not a constructed and imaginary basket of goods has become more expensive or less expensive, and if so by what percentage amount from an earlier point in time.

Changes in the cost of living affect each of us differently based on the reality of what we as individuals and separate households choose to buy and in what relative amounts. Also, our individual baskets are not invariant points of comparison even for ourselves, since changes in our tastes and preferences, in the relative prices among the goods we buy, and in the market’s offering of new and better quality goods on a frequent basis all bring about changes in what goods are in our respective baskets and their relative quantities.

Such statistical creations as the Consumer Price Index are at most very rough-and-ready general pieces of information for the consumer or citizen concerning what the central bank may be doing to the overall value of the money we use. The fact is, its importance is not for you or me, but as one of the signals used by the central bankers to decide the rate of monetary expansion and for influencing interest rates. (See my articles “The Consumer Price Index, a False Indicator of Our Individual Costs-of-Living” and “The False Promises of Controlled 2 Percent Inflation.”)

It’s all based on a macroeconomic conception that in general a falling price level is “bad,” and that growth and employment are “stimulated” by modestly rising prices. It has fallen mostly (though not exclusively) to the Austrian school over the last 100 years to demonstrate that falling prices due to greater outputs and supply-side cost efficiencies are not only not harmful to the wealth and health of modern society, but are an indication of increasing prosperity and rising real standards of living. (See my article “Don’t Fear Deflation, Unless Caused by Government.”)

Likewise, whether it is the attempt to maintain a relatively stable general level of prices (as partly guided Federal Reserve policy in the 1920s) or the contemporary central bank target of 2 percent price inflation, the primary institutional tool at the Federal Reserve’s disposal is to buy U.S. government securities (and now a variety of other market assets including mortgaged-backed securities during the financial crisis of 2008-9 and after) and to increase loanable reserves in the banking system. (See my article “Austrian Monetary Theory vs. Federal Reserve Inflation Targeting.”)

This becomes the means for influencing interest rates for investment and all other types of borrowing to try to “stimulate” spending and employment in the economy as a whole. Even the Fed’s latest policy trick since the financial crisis to pay banks not to lend the very trillions of dollars of excess reserves the central bank pumped into the banking system is a way for the Federal Reserve to try to influence interest rates and aggregate spending in the economy.

The fact is, interest rates should be left free and competitive to do their job as the network of intertemporal prices connecting and coordinating the savings decisions of lenders with the investment choices of borrowers. In other words, interest rates are the prices that are supposed to bring markets and the use of the factors of production into balance with each other across time.

Instead, by viewing and using interest rates as a policy tool to be manipulated, the Federal Reserve’s monetary central planners only succeed in distorting and preventing interest rates from telling the truth: how much savings is in the economy to sustain and maintain a structure of gross and net investments with varying time horizons. (See my article “Interest Rates Need to Tell the Truth.”)

Just as Soviet central planners may have believed that they could coordinate it all for better and more successful outcomes than market economies, our central bankers never fail in their enthusiasm and arrogant confidence that this time they will get it right, that they “now” have the right macroeconomic model of how it all works; they, finally, have bigger and better statistical data and computer capacity to successfully read and measure the entrails of the economic goose. (See my articles ”Macro Aggregates Hide the Real Market Processes at Work” and “The Myth of Aggregate Demand and Supply.”)

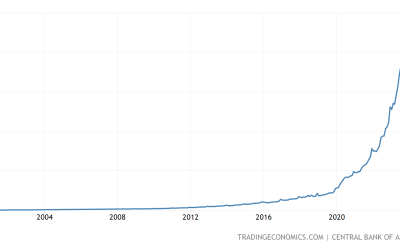

What they, in fact, bring about are the inflations and recessions, the booms and busts that they insist they are in the central banking business to moderate, if not to prevent. By their fruits you will know them: the post-World War I inflation and depression; the 1920s false promise of prosperity and stability, followed by the Great Depression; the booms and busts of inflations and recessions in the 1950s; the monetary inflation of the 1960s and especially the high price inflation of the late 1970s and early 1980s; then a relative calm in the 1990s, but followed by the monetary expansion between 2003 and 2008 that set the stage for the great financial and housing crisis of 2008-10; and now the great experiment with “quantitative easing” and the ballooning Federal Reserve asset portfolio filled with private sector mortgages. (See my article “Ten Years On: Recession, Recovery, and the Regulatory State.”)

The long history of central banking, and especially over the last 100 years of paper monies and out-of-control government deficit spending partly funded by “monetization” of the debt, has more than clearly demonstrated that the epoch of modern central banking needs to come to an end. And in its place, we need the opening and freeing of financial markets to private competitive free banking, with markets — meaning all of us — deciding what we want to use as money. (See my eBook Monetary Central Planning and the State.)

Made available by the American Institute for Economic Research. Visit their website at https://www.aier.org.