One of the leading policy guideposts for central banks and many monetary policy proponents nowadays is the idea of “inflation targeting.” Several major central banks around the world, including the Federal Reserve in the United States, have set a goal of two percent price inflation. The problem is, what central bankers are targeting is a phantom that does not exist.

Perhaps we can best approach an understanding of this through an appreciation of some of the writings by members of the Austrian School of Economics on matters of monetary theory and policy. Carl Menger (1840-1921), the founder of the Austrian School in the 1870s, had explained in his Principles of Economics (1871) and his monograph on “Money” (1892), that money is not a creation of the State.

Money Emerges from Markets, Not the State

A widely used and generally accepted medium of exchange emerged “spontaneously” – that is, without intentional government plan or design – out of the interactions of multitudes of people over a long period of time, as they attempted to successfully consummate potentially mutually advantageous exchanges. For example, Sam has product “A” and Bob has product “B”. Sam would be happy to trade some amount of his product “A” for some quantity of Bob’s product “B”. But Bob, on the other hand, does not want any of Sam’s “A”, due to either having no use for it or already having enough of “A” for his own purposes.

Rather than forego a desirable trading opportunity, we can easily imagine Sam believing that Bob might be willing to take some other commodity or product in trade for his product “B”, if only Sam had some of whatever it is. So Sam might decide to first trade an amount of his product “A” for a quantity of Bill’s product “C”. Not because Sam has any need for it himself, but because he anticipates that if he were to have some amount of “C”, Bob would gladly take it in trade for some his product “B”, which is what Sam actually wants to acquire.

In this instance, product “C” has been used by Sam as a medium of exchange – something purchased by Sam not for any immediate and direct use himself, but as something to be traded away, again, in exchange for what Sam really wants to obtain: an amount of product “B”, given that the owner of product “B” had no desire or use for Sam’s original product “A”.

Over time, individuals discovered that some goods possessed a variety of qualities, characteristics and attributes that made them more useful than others in this role of a medium of exchange – particular goods that were in wider and greater demand than others; goods that were more easily divisible into amounts reflecting agreed-upon terms of trade without losing their desired features as useful goods; more durable goods, so they may be stored for future exchange opportunities without a significant decrease in their marketable qualities; and goods that were more conveniently transported to where advantageous trades might be possible at some point in the future.

Individuals, in their own self-interest, would find it advantageous to first exchange their own, less marketable goods for such other more marketable ones before searching for trading opportunities to acquire the goods they actually wanted. Having possession of a relatively more marketable and salable good would increase the likelihood of being able to obtain from others those goods that were desired for various consumption or production purposes.

Observing the successes of some in this endeavor, Carl Menger said, would reinforce others to also demand the same more marketable good to use as a medium of exchange. Or as Carl Menger explained in his, Investigations in the Methods of the Social Sciences (1883):

Each individual could easily observe that there was a greater demand in the market for certain wares, namely those which fitted a very general need, than there was for others . . .Thus, every individual who brought to the market items of slight marketability . . . had the obvious idea of exchanging them not only for goods he needed, but also for others . . . which were more marketable than his . . . The economic interest of the economic individuals, therefore, with increased knowledge of their individual interests, without any agreement, without legislative compulsion, even without any consideration of public interest, leads them to turn over their wares for more marketable ones . . . The origin of money can only be truly understood . . . as the unintended result, as the unplanned outcome of specifically individual efforts of members of society.

The Value of Money and the Market-Based Medium of Exchange

Menger’s analysis of the market-generated origin of money became the starting point for later Austrians analyzing the nature, workings and problems of money in society. This was particularly true of Ludwig von Mises (1881-1973), in his, The Theory of Money and Credit (1912; 2nd revised ed., 1924). One of Mises’ main concerns was to explain the determination of the value of money and how changes in money’s general purchasing power were brought about.

For any good or commodity to emerge as the money-good in a society, it clearly first had to have a use and a value as an ordinary marketable good for either direct consumer uses or indirect production applications. Otherwise, in that historically distant past, no one would have seen an advantage to obtain it in exchange to, then, plan to trade it away for something else they actually wanted to buy, since there would be no one else who would want it and take it in trade.

But once this particular commodity was being used, also, as a medium of exchange, Mises argued, part of its market value was now based upon its demand for and use as a “money,” besides its parallel and separate value and demand as an ordinary good having consumption and production uses. Indeed, Mises reasoned, over time the money demand and value for this commodity might come to overshadow and supersede its original non-monetary uses and demands. In the extreme, if this good through use, custom, habit and tradition had become the money-good in a society, it could even lose its original non-monetary uses and values and still have its demand and market-based value as the generally accepted and most widely used medium of exchange.

Of course, looking over the centuries, the most widely used and generally accepted commodities for such money purposes have been gold and silver. Not that other goods have not also served as monies at different times and different places, but gold and silver often have been the predominant ones in many parts of the world, and especially in “the West” with the development of capitalist or market-based institutions of trade and finance.

Money’s Exchange Value and the Demand for Cash Balances

But what is the “value” or purchasing power of money in the marketplace? Money, the Austrians argued, is an unusual good in the arena of exchange. As a particular good comes to be more widely and generally used, it becomes customary practice to first trade away ones own good or service in the division of labor in exchange for a sum of the money-good, with the plan and intention of then turning around and trading the money one has earned as a “supplier” of goods to now be a “demander” of other people’s goods. Goods are traded for money, and then money is traded for goods.

With, increasingly, money on one side of every exchange, every other good tends to now have one price, their individual money-price. For instance, the dollar price for a hat, the dollar price for a pair of shoes, the dollar price for a suit of clothes, the dollar price for a dozen eggs, the dollar price for a bushel of wheat, and so on. But money, on the other hand, continues to have no single price. Instead, it has as many prices as goods against which it trades. Money’s value is reflected in the array, or network, or set of all the individual exchange ratios between money and each of the large number of individual goods against which it trades in the market.

The value of money, as with all other market activities, is the outcome of the interaction of supply and demand. But the demand for money, unlike other goods and services bought and sold in the marketplace, is not to be used and consumed but to be held as a desired average cash balance over a period of time to facilitate future exchanges, whether those trades are only a few minutes away or a significant distance in the future. Each individual decides how much of his earned money income from selling goods or offering services should be held as an average cash balance over the income period to undertake future transactions until the next inflow of money income from the sale of one’s goods or labor services.

While a number of monetary theorists have highlighted the “objective” institutional constraints that influence any person’s decision concerning how much of an average cash balance to hold over an income period – the timing of when bills come due during a month, the frequency with which individuals are paid by their employers, or the habits of how frequently people do their ordinary shopping – the fact is, Mises and other Austrians argued, the decision and choice of holding cash balances of various amounts may have to take into consideration such institutional surroundings, but, ultimately, it is a matter of personal, or “subjective,” judgment and evaluation that cannot not be mechanistically determined or predicted.

The interaction of suppliers of goods in exchange for money, and possessors of cash balances of money choosing to demand goods together determines the money prices for all the goods and services bought and sold, produced and consumed, in the marketplace. Out of these interactions emerges the formation of the structure of relative money prices for finished goods and the factors of production (land, labor, capital) out of which those finished goods are manufactured. And the height or “scale” of this general structure of relative money prices at the same time the represents the purchasing power or general value of money in the marketplace.

Individuals, Relative Prices, and Changes in the Value of Money

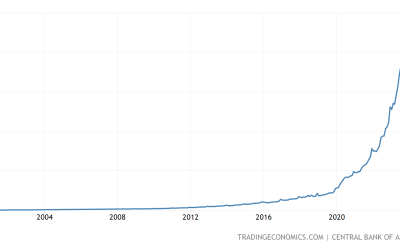

If individuals find themselves, for some reason, with greater amounts of money in their possession, and therefore with larger cash balances of money than they find it attractive and advantageous (at the margin) to hold in comparison to other goods they could possess, they will spend these “excess” cash balances in the marketplace for those other desired goods. Given the available supplies of those purchasable goods and services, the greater sums of money offered in trade for them will tend, over time, all other things held given, to push up their prices, as people competitively bid against each other to purchase them with those extra amounts of money offered for them. Thus, there occurs, over time, a general rise in the scale of prices in the economy as a whole.

But the particular contribution of Ludwig von Mises and a number of other Austrian economists has been to emphasize that changes in the quantity of money in the market does not bring about a general rise in prices either simultaneously or proportionally. Any changes in the quantity of money always appears in some particular point in the market, and finds its way into the hands of particular individuals. As Mises expressed it Monetary Stabilization and Cyclical Policy (1928):

If the quantity of money increases, the additional new quantity of money must necessarily flow first of all into the hands of certain definite individuals – gold producers, for example, or, in the case of paper money inflation, the coffers of the government. It changes only their incomes and fortunes at first and, consequently, only their value judgments. Not all goods go up in price in the beginning, but only those goods that are demanded by these first beneficiaries of the inflation. Only later are prices of the remaining goods raised, as the increased quantity of money progresses step by step throughout the land and eventually reaches every participant in the economy.

But even then, when finally the upheaval of prices due to the new quantity of money has ended, the prices of all goods and services will not have increased to the same extent. Precisely because the price increases have not affected all commodities at one time, shifts in the relationships in wealth and income are effected which affect the supply and demand of individual goods and services differently. Thus, these shifts must lead to a new orientation of the market and of market prices.

From this “Austrian” perspective, therefore, focusing attention on changes in the general “price level” of goods and services hides from view an appreciation and understanding of all the relative price and wage changes and shifts in the allocation of resources and the distribution of income that is the inescapable essence of the “dynamics” of monetary changes within the market economy.

Indeed, any resulting change in the general purchasing power or value of money as reflected in some calculated or measured “general price level” or “rate” of general price inflation is only the cumulative outcome of all the individual price changes that have brought about a rise of one price or group of prices after another in a particular temporal sequence. There cannot be a general rise in prices independent of and separate from these individual relative price and wage changes in whatever pattern they may follow through time based upon the particular “injection” point from which an increase in the money supply had been introduced into the economy.

The reason for this, of course, being that it is only individuals who experience an increase in their available money balances, who undertake new and additional purchases on particular goods and services reflecting their tastes, preferences, and investment decisions concerning on what to spend this increase in the money supply that has come their way.

Price Deflation, Price Level Stabilization, and the Great Depression

First Ludwig von Mises and then Friedrich A. Hayek (1899-1992) in, Monetary Theory and the Trade Cycle (1929) and Prices and Production (1932) demonstrated that it is when increases in the supply of money and credit are introduced through the banking system by an “activist” monetary policy of a central bank, that it may set in motion the boom and bust of the business cycle.

The particular insight, especially in Hayek’s writings at this time, was to demonstrate that even a monetary policy that only increases the money supply sufficiently to maintain a “stable price level” in what would otherwise be a period of “deflationary” falling prices still brings about an potential imbalance between savings and investment due to manipulations of market interest rates.

Indeed, if prices, one after another, are generally declining due to economic progress – increases in industrial productivity, new or improved cost efficient methods of production – that enables more and better goods to be offered at lower prices to the benefit of the general consuming public, then this should be considered a “good deflation.” Any increases in the money supply to counteract such a price deflation may not only thwart it but also end up generating economic distortions and imbalances that may require a period of wrenching readjustment when a monetary-created boom turns into an economic bust.

This was the “Austrian” explanation for the causes of the Great Depression, since through a good part of the 1920s, the U.S. Federal Reserve had attempted to maintain a fairly stable price level through monetary expansion in the face of economy-wide cost efficiencies and manufacturing improvements that Hayek and other Austrians were defining precisely as an instance of such a “benign deflation.” As Hayek explained in 1932:

Instead of prices being allowed to fall slowly [in the 1920s], such volumes of additional credit were pumped into circulation [by the Federal Reserve] that the level of prices were roughly stabilized . . .Whether such inflation merely serves to keep prices stable, or whether it leads to an increase in prices, makes little difference. Experience has now confirmed . . . that such inflation can also lead to production being misdirected to such an extent that, in the end, a breakdown in the form of a crisis becomes inevitable.”

(See my eBook, Monetary Central Planning and the State [2015].)

Arbitrary Construction and Limited Relevance in Price Indexes

In addition, however, is the issue of what is the “price level” and rates of changes in it that central banks choose to track and target to aim at a general two percent rate of annual price inflation? To know if prices, in general, are rising or falling, it is necessary to have some benchmark from which any percentage change is being measured. For this purpose, for more than a good century and a half, economists and statisticians have devised “index numbers” to determine changes in the “price level”.

A “basket of goods” is constructed by selecting a variety of commodities that are then “weighted” in terms of the relative amount of expenditures devoted to them out of a given income. The “basket” is than tracked through time to determine and calculate by how much this basket then costs – more, less, or the same – at some point in the future in comparison to the benchmark starting year from which the estimate is being made.

But by what standard and by whom is the “basket” being constructed? The most common one heard in the news is the Consumer Price Index (CPI). But there also is the “Core” Price Index (the CPI minus food and energy prices), the Producer Price Index, the Wholesale Price Index, a “fixed” or “chain weighted” price index, a national price index vs. regional price indices. The list goes on, with some of these price indices constructed by government agencies and others by private research institutes.

The fact there is no “objectively” right or wrong index to have a “correct” measurement of prices and any movements in them over time. It all depends upon the purpose behind the index’s construction and its use. Furthermore, there is an inescapable arbitrariness in an index’s composition. Someone has to decide which goods and their particular prices are the relevant and representative ones; someone has to decide the relative “weights” to assign to each of the goods or services included in the “basket.” And there must be judgments to ignore or downplay that during the time period over which the price index is being tracked, numerous changes may occur that undermine the constancy and reliability of the components contained within it.

While the general value or purchasing power of money is made up of the multitude of individual price ratios between money and each of the goods against which it trades, the relevance and significance of any of those money prices for individuals in the marketplace depends upon the actual goods and the relative amounts a consumer purchases, and the particular production inputs and their amounts a specific manufacturer or producer or seller utilizes in his business. Plus the goods and their relative amounts purchased in these individual consumer and firm-level circumstances change over time with changing circumstances, including the relative prices among the good used for different purposes. (See my article, “The CPI is a False Guide for Monetary Policy”.)

The Price Level vs. Relative Prices in the Business Cycle

Gottfried Haberler (1900-1995), an active member of the Austrian School in the 1920s and 1930s, pointed out, for instance, in 1928:

The general price level is not a given, self-evident fact, but a theoretical abstraction. It is a scientific tool that has to serve for certain scientific and practical purposes, such as comparison of real income, establishment of a standard for deferred payments, guidance for monetary policy. It is often tacitly assumed that there is only one price level which serves all those purposes . . . This assumption is, however, erroneous . . . For each purpose a separate concept of a price level must be established. An economically relevant definition of price level cannot be independent of the purpose in mind.

And Haberler further emphasized that any such economy-wide price index used as a guide for monetary policy hides from view all of the actual market relationships between and among goods as actually reflected in the structure of relative prices and wages throughout the processes of production:

It is undeniable that business activity in each several branch depends primarily on a few prices – on the relation of the prices of raw material, its machinery equipment, and labor on the one hand, and the prices of its products on the other. This has, however, obviously nothing to do with a general price index, for in an index exactly those features of the behavior of prices disappear which are relevant [for understanding the business cycle]. The relative position and change of different groups of prices are not revealed but are hidden and submerged in a general index.

Thus, when the U.S. Federal Reserve or any other central bank around the world sets, for instance, a two percent price inflation target as a guide for monetary policy, it is targeting something that does not really exist “out there,” but is the arbitrary construction of economic statisticians who have decided some things are more relevant than others, with a wide variety of subsidiary assumptions that cloud the fact that there is nothing determinate or constant in which they are tracking. And that what is “meaningful” for the monetary policy maker may have little or nothing to do with what is meaningful and relevant in terms of prices and expenditures, standards of living or profitabilities in production, for the actual consumers and producers in the various corners of the marketplace.

Finally, the central banker’s very focus on a general economy-wide price index for pursuing a policy that is presumed to assist in maintaining stability, balance and growth in the market as a whole, hides from view the very distortions, imbalances, and misdirection of resources, labor and capital that their own monetary policy brings about due to how any and all monetary changes upset and twist the structure of relative prices, wages and input uses upon which a healthy market-oriented economy is ultimately dependent.