Let’s say a guy is about to counterfeit millions of dollars and spend it in his town (he’s been empowered by secret government commission) with the goal of producing a perceived economic boom. To have the greatest effect, would he be better off publicly announcing his intention to counterfeit with the proviso that if prices go up too much he will stop, or would he be better off spending the counterfeit money in secret?

If he announces his intentions, banks and businesses in the town will immediately begin to factor his future spending into their prices and inventory decisions. His promise to stop counterfeiting if prices go up too much will also be taken into account. Knowing that an indefinite counterfeiting operation will ultimately force prices higher, they will conclude that it is unlikely he will counterfeit indefinitely and will regard the increased spending as temporary. As he buys more of their goods, they will experience an improved bottom line in the near term, but they will not be incentivized to expand their operations or hoard inventory in the hopes that prices will just keep going up and up as he spends and spends. The boom is unlikely to ever materialize.

On the other hand, if he secretly counterfeits and begins spending the money, businesses will notice that they are selling more and more. Even if they raise their prices a little they will see their sales increase and conclude it is part of a new trend. As prices go up everywhere, they will realize they can purchase more inventory and just wait for prices to go up further. Banks will be flush with deposits and able to make loans on more generous terms. Businesses will expand their operations. The town will believe they are experiencing a boom.

Notice that for his counterfeiting to result in a perceived boom, he had to trick everyone into thinking that the increased spending volume is real and would continue indefinitely. It needed to appear that the increased deposits in the bank reflected the real desire of individuals to save more money for longer periods so that businessmen would be fooled into pursuing longer term projects that consume massive amounts of capital. Conversely, when the businesses anticipated the end of counterfeiting, the whole effect of his actions was relatively inconsequential. As Ludwig Von Mises wrote in his economic treatise Human Action:

The boom-creating tendency of credit expansion can fail to come only if another factor simultaneously counterbalances its growth. If, for instance, while the banks expand credit, it is expected that the government will completely tax away the businessmen’s “excess” profits or that it will stop the further progress of credit expansion as soon as”pump-priming” will have resulted in rising prices, no boom can develop. The entrepreneurs will abstain from expanding their ventures with the aid of the cheap credits offered by the banks because they cannot expect to increase their gains.

Unless the businesses believed they could continually gain from the trend, they will not act to expand their business. In this way, the example shows that even if the man had kept counterfeiting, he would have had to accelerate his pace of counterfeiting to keep the boom going (increasing the gains of the gains) and eventually he would have destroyed the town’s monetary system. Von Mises wrote:

The boom can last only as long as the credit expansion progresses at an ever-accelerated pace. The boom comes to an end as soon as additional quantities of fiduciary media are no longer thrown upon the loan market. But it could not last forever even if inflation and credit expansion were to go on endlessly. It would then encounter the barriers which prevent the boundless expansion of circulation credit. It would lead to the crack-up boom and the breakdown of the whole monetary system.

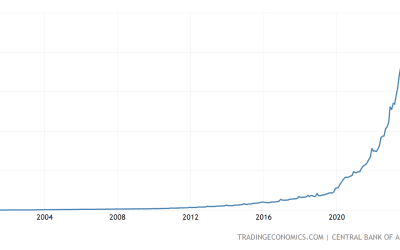

Since that bubble burst in the 2008 crisis, global central banks such as the Federal Reserve, ECB, and Bank of Japan have embarked on an effort seemingly to create another phony credit boom. But this time, they have maintained a policy of publicly announcing their so-called “quantitative easing” efforts in advance. They have generally pledged to buy their government’s bonds (with fake money) of a certain magnitude for a certain period of time with the goal of increasing consumer prices along with the proviso that if prices rise too quickly then they will stop and potentially even go in reverse, i.e., remove money from the monetary system. As we would expect based on the above, despite their best efforts, these central banks have been unable to create the kind of phony boom they so desperately crave.