I’m very well acquainted… with matters mathematical,

I understand equations, both the simple and quadratical,

About binomial theorem I’m teeming with a lot o’ news,

With many cheerful facts about the square of the hypotenuse.

I’m very good at integral and differential calculus;

I know the scientific names of beings animalculous:

In short, in matters vegetable, animal, and mineral,

I am the very model of a modern Major-General.[1]

One of the chief goals of Cato’s Center for Monetary and Financial Alternatives is to make people aware of alternatives to conventional monetary systems—that is, systems managed by central bankers wielding considerable, if not unlimited, discretionary authority. The challenge isn’t just one of informing the general public: even professional monetary economists, with relatively few exceptions, are surprisingly ill-informed about such alternatives.

I recently came across a document that perfectly illustrates this last point: a power point presentation by a senior Federal Reserve Bank research economist, given at a conference aimed at school teachers specializing in economics.

I have no desire to single-out the economist in question, who I will therefore refer to simply as “our economist.” On the contrary: I offer his presentation as an example of the all-too common tendency for otherwise competent monetary economists (and our economist is in fact very accomplished) to misread the historical record regarding potential alternatives to central banking and to otherwise give such alternatives short shrift.

This unfortunate tendency rests in part on the fact that most economics graduate programs stopped teaching any sort of economic history decades ago (our economist earned his PhD in the early 1990s), while burdening their students with enough mathematics and statistics to all but guarantee that they never so much as crack open a book on the subject. But the trouble isn’t just that many monetary economists don’t know their monetary history: it’s that they know, and teach, monetary history that ain’t so. That’s what our economist did when he lectured a roomful of teachers on the merits of central banks and “Alternative Monetary Systems.”

The first sign of our economist’s limited awareness of “Alternative Monetary Systems” appears in a slide listing the topics he plans to address. These are: (1) “What is Money?”; (2) “Methods of Monetary Policy”; (3) “Central Banks”; and (4) “Central Banks vs. Commodity Standard.” The last dichotomy makes little sense, both because central banks and commodity standards, far from being mutually exclusive, coexisted for much of the early history of the former, and because one can have a fiat monetary standard without having a central bank—as the U.S. did between 1863 and 1879 and as Hong Kong and other places equipped with currency boards do today.

On a later slide our economist does at least mention currency boards. But he still fails to recognize explicitly the distinction between monetary systems—whether commodity or fiat—in which paper currency is monopolized and those in which it is competitively supplied. The only reference he makes to the competitive alternative is an implicit one, in a slide referring to the instability of the pre-1914 U.S. economy.

I’ll have more to say about that slide in a moment. But before he comes to it, our economist takes up the topic of commodity standards. According to him, under such standards, the money supply changes only as “People dig holes in the ground, haul out ore and turn it to the central bank for money.” That will do, I suppose, if one’s purpose is to make such standards appear hopelessly primitive compared with ones that allow for monetary “fine tuning.”[2] But as a summary of how actual commodity standards, and the classical gold standard in particular, worked, it is extremely misleading. Although the mining of new gold was an important determinant of long-run gold-standard money supply changes, in the short run it was far less important than international gold flows, movements of gold from non-monetary to monetary uses and vice versa, and changes in bank reserve ratios and other determinants of base-money multipliers.[3]

Rather than mention any of these often stabilizing determinants, our economist invites his audience to imagine what would happen, under a gold standard, to the price level (among other things) if “we just conquered a good portion of the New World.” Although his slide doesn’t say what visions he helped his listeners to conjure up, I will bet you top dollar (1) that he told them about the great “Price Revolution” of the 15th-17th centuries, when specie shipments from Mexico caused prices in Western Europe increased six-fold; and (2) that he did not tell them that this six-fold increase over the course of 150 years amounted to an annual inflation rate of between 1 and 1.5 percent, that is, a rate that the Fed and other central banks now consider dangerously low.

Our economist next makes a case for central banking, by arguing that there must be a lender of last resort. Like many monetary economists whose understanding of bank panics is informed by Diamond and Dybvig’s (1983) ingenious but extremely misleading article on the subject, he asserts that “Bank runs can be self-fulfilling,” ignoring evidence that, in the U.S. at least, they have seldom been so. Rather than consult that evidence he refers to the bank-run scene in It’s a Wonderful Life.[4] Ben Bernanke would later take the same tack in the course of his GWU lectures.[5] Whether our economist has read Bagehot’s Lombard Street is unclear. In any event there’s no evidence that he share’s Bagehot’s understanding that a lender of last resort is something a country needs only once it has taken the unfortunate step of establishing a privileged bank of issue in the first place.

We thus arrive at our economist’s review of pre-Fed experience, which he summarizes with a slide showing the gyrations of U.S. GDP between 1880 and 1914, and highlighting the panic years 1884, 1890, 1893, and 1907. The slide’s title asks “Why Do We Need a Lender of Last Resort?” The implicit answer is: “Look at all the panics we had when we didn’t have one!”

To draw lessons from history is a fine thing. But it is not fine to look only a selective bits of history, ignoring other bits and even some large chunks, depending on which pieces do or do not affirm one’s prior beliefs. For his part our economist selects the 34 years prior to the Fed’s establishment, while setting aside the 34 following its establishment. He is thus able to overlook some awkward facts, to wit: that the number of banking crises was actually greater after 1914 than before; and that on three occasions (1920, 1930-33, and 1937-8) the percentage decline in output was greater than it had been in any of the pre-Fed crises. Indeed, even setting the tumultuous interwar period aside, while employing the best available statistics, it isn’t clear that the Fed has brought any substantial improvement in macroeconomic stability.

Because our economist refers only to U.S. experience, his listeners may also not have learned that banking crises were far more common in the pre-1914 U.S. than they were in other nations that l lacked central banks. In particular, they may not have been told that Canada altogether avoided the crises by which the U.S. was buffeted, and did so despite being on the same gold-based dollar standard and despite being a much smaller and less-diversified economy. Indeed, it seems quite unlikely that our economist told them, for doing so would have reduced his argument for having a central bank into a transparent non sequitur. Nor was there any peculiar or mysterious reason for Canada’s having managed to avoid crises without a central bank such as might justify setting its example aside. The Canadian system was stronger because, unlike their U.S. counterparts at the time, Canadian banks were allowed to establish nationwide branch networks, and were free from regulations limiting their ability to issue circulating banknotes. Restrictions of the latter sort, dating from the Civil War, were the fundamental cause of frequent U.S. currency shortages and occasional currency “panics” like the one in 1893.

In short, far from proving that the U.S. needed a lender of last resort, a careful look at U.S. monetary experience reveals (1) that what “we” really needed was to deregulate U.S. banks by letting them branch and by letting them issue notes backed by their general assets; and (2) that a “lender of last resort” was not just a poor substitute for such deregulation, but one that was tragically flawed.

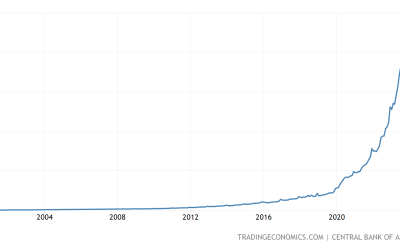

The rest of our economist’s talk is devoted to the question of optimal inflation and alternative monetary policy targets, including the Taylor Rule. Here, too, his understanding is at best highly conventional and, at worst, extremely indulgent of the Fed’s shortcomings. He never considers the very different implications of productivity- and demand-driven deflation, much less the possibility that there might be some advantage to having either a variable inflation rate or one that’s ever negative. He makes no mention of the sharp increase in price-level uncertainty that has occurred since the Fed’s establishment, and especially since 1971. And he shrugs off the even more serious decline of the dollar’s purchasing power, blandly observing that practically all economists these days believe “that low and stable inflation has very low costs” (as if U.S. inflation has always been “low and stable”); that it isn’t useful to compare price level measures across long intervals because they involve different baskets of goods (as if most of the 96 percent decline in the dollar’s purchasing power since 1914 could be written-off to what ought to be unbiased statistical errors ); and that inflation is often due to wars (as if the Fed’s role as handmaiden to the U.S. Treasury had nothing to with past wartime price increases).

Enough. By now it should be perfectly obvious that our economist doesn’t really give a toss about “Alternative Monetary Systems.” The Federal Reserve System is, so far as he’s concerned, the best of all possible monetary systems. He gathers together hackneyed arguments in its defense, including just as much economic history as serves to affirm, but never to challenge, received opinion. He believes that he’s being objective, when in reality he’s got a severe case of status quo bias. He asserts that the opinions he expresses are his own, rather than those of a spokesman for the Federal Reserve System, without appearing to realize that a Fed spokesman would be hard-pressed to paint the Fed in more glowing colors.

But my intent, as I said at the onset, isn’t to single out our economist for a rebuke. His understanding of history and of alternative monetary systems is no worse than that of a thousand other otherwise competent monetary economists. It is proof, not of his own failure, but of the sad state of contemporary monetary economics. Above all, it underscores the dire need for an organization devoted to taking alternative monetary systems seriously.

[1] The Major-General’s song, from Gilbert and Sullivan’s Pirates of Penzanse.

[2] And hyperinflation.

[3] For a discussion of some of these determinants see chapter 2 of Lawrence White’s The Theory of Monetary Instututions (London: Blackwell, 1999).

[4] Most historical bank runs have been informed by prior information suggesting that the afflicted institutions might be insolvent.

[5] As they never refer to the bank run depicted in it, I suppose that Fed experts consider Mary Poppins to offer insufficiently “rigorous” evidence of how and why runs happen.

The post The Very Model of a Modern Monetary Economist appeared first on Alt-M.