Many blame capitalism for the current financial crisis. Even Alan Greenspan, who at one time was an advocate of the free market, blames capitalism. Last year he testified in front of a congressional committee that “A critical pillar to . . . free markets did break down. I still do not fully understand why it happened.” The first thing that Greenspan and most other commentators on the crisis must do to understand why the crisis occurred is to learn that the free market did not cause the crisis because the U.S. is not even close to being a free-market economy. Massive government interventions in the market in the form of myriad regulations and financial irresponsibility on the part of the government are really to blame. This makes the “solution” being imposed doubly absurd: more government controls, borrowing, and spending to solve the problems created by government controls, borrowing, and spending.

But this isn’t surprising. Ayn Rand observed decades ago that “one of the methods used by statists to destroy capitalism consists in establishing controls that tie a given industry hand and foot, making it unable to solve its problems, then declaring that freedom has failed and stronger controls are necessary.”

The real solution to the financial crisis is not more financial irresponsibility and government controls, but forcing the government to be financially responsible and abolishing the controls. This means we need to establish a free market in our financial system. As a part of the move to a free market, we need to establish a full-fledged gold standard–one that the government must be prevented from breaching. This is something we have never had in this country. We have been on a gold standard before, but the government intervened in many ways–from the very start of the nation–to undermine the gold standard, such as by issuing unbacked paper currency. The absence of a full-fledged gold standard has made it possible for the government to create periodic financial crises and depressions throughout our history. Abolishing controls and moving to a gold standard will not only help get us out of the current crisis but help prevent future crises as well.

How did the government cause the current crisis?

Consider these examples. The Fed injected massive amounts of money and credit into our financial system from 2001 to 2004 that led to skyrocketing housing prices and fostered irresponsible borrowing and lending by market participants. The Community Reinvestment Act of 1977 is used to intimidate banks and other mortgage lenders into making loans–such as subprime loans–in low- and moderate-income neighborhoods. Many of these loans would not have been made in a free market because they were made to borrowers who were not credit worthy. Making loans to people who cannot afford them is a policy that is destined to lead to a financial catastrophe.

In addition, Fannie Mae and Freddie Mac, enterprises created by the government to increase mortgage lending, foster irresponsible borrowing and lending by purchasing mortgage loans from lenders. Fannie and Feddie have been able to purchase large amounts of loans because, since their creation, they had the implicit financial backing of the government. Now that the government has taken them over, that backing is now explicit. Federal Home Loan Banks also engage in and foster irresponsible and excessive borrowing and lending. They can do this only because, as stated by The Wall Street Journal, they “benefit from a widespread belief the government would bail them out in a crisis.”

The government appears to be a financial savior because the Fed has the power to create money. But the Fed’s creation of money does not solve problems; it creates problems. It causes prices to rise rapidly, devalues our savings and income, makes business planning and investing more difficult and risky, promotes more government borrowing, spending, and consumption, undermines economic progress, and thus lowers the standard of living in the economy. The situation is dire. The government is consuming our seed stock and no one seems to care!

To solve the problem, we need to get the government out of the money creation business and prevent it from taking us down the road to fascism. We need to tie the hands of government officials to force them to obey sound financial principles that every responsible individual obeys. We need to stop the government from making fascist power grabs, such as the one in which Treasury Secretary Henry Paulson recently coerced CEOs from the country’s nine largest banks with, as reported by The New York Times, a “take it or take it offer” to sell the government shares in their companies as a part of the massive government bailout. We need to limit the government’s ability to tax to instill financial responsibility in government and protect the right of individuals to keep the income they earn.

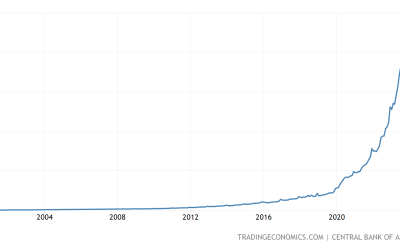

The government has become more financially irresponsible with every step we have taken away from gold. It’s no accident that government borrowing and spending soared as we moved off gold, and the price of gold has risen from $20.67 per ounce to as high as about $1000 per ounce recently. The gold price has risen because the Fed has injected so much money and credit into our financial system that the demand for gold has increased tremendously. A full-fledged gold standard would prevent the Fed from creating money and thus radically limit the spending in which the government can engage.

The gold standard is not as far-fetched as one might think. President Reagan established a commission to consider a return to gold. Today we need merely have the courage, which that commission lacked, to move back to the gold standard. With a fully-backed gold standard–where each dollar is backed by a dollar of gold–we can require individuals to be financially responsible, or suffer the consequences, without bringing down the rest of the economy or decreasing spending in the economy one cent. Under a fully-backed gold standard, we can let companies that are allegedly “too big to fail” fail. We just need to define a new gold dollar at a high enough price in paper dollars for the existing supply of potential monetary gold to be able to back the number of dollars in existence. This, along with abolishing other government controls, will make it possible to instill financial responsibility into the economy and lift the burden of onerous regulations.

These are radical solutions but desperate times call for radical measures.

To move forward, we need to abandon the profligate, short-range policies of Keynesian economics and the Marxist ideas that are used to justify government controls. We need to adopt the financially disciplined, long-term policies of “Austrian” economics, in particular that of its best expositor: Ludwig von Mises. Such policies need to be based on a respect for individual rights and freedom, as argued by Ayn Rand. If we don’t do this, not only will we all be dead in the long run, we will be in financial and economic ruins as well–and the type of ruins I’m referring to will make today’s financial crisis seem like prosperous times!